Choosing Insurance is hard. We make it easy!

Are you confused about your Medicare Options ?

Medicare Resources for you!

Getting Started

When should you start to enroll into Medicare? When and how do you become eligible for Medicare?

Learn MoreWhat are the Medicare Enrollment Periods?

Medicare Enrollment Periods may be complicated. But its important to stay informed and up-to date on enrollment periods to avoid penalties or coverage gaps.

Learn MoreMaking sense of the different parts of Medicare

Medicare consists of Parts A, B, C and D. Learn about the different parts and how they work, and what your options are with each part.

Learn MoreWhat are Medicare Advantage Plans?

Medicare Advantage plans are provided by private insurance companies and can often save you money.

Learn MoreWhat are Medicare Supplemental Plans?

These are Insurance plans offered by private insurance companies that help cover Medicare’s gaps, and are called “MediGap” plans

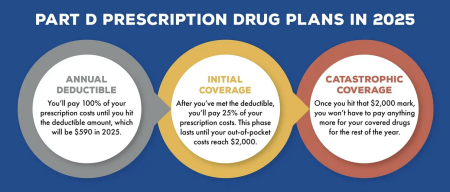

Learn MoreWhat is Medicare Part D?

Medicare Part D is coverage for your Prescription medications and is provided by private insurance companies.

Learn MoreQuestions about Medicare and Working Past 65?

As an increasing number of Medicare eligibles are working past 65, it is important to connect with a licensed Medicare Agent to help navigate your next steps.

Learn MoreWhat are Special Needs Plans?

Special Needs Plans (SNPs) are Medicare Advantage plans that meet the needs of individuals with certain health conditions or circumstances.

Learn MoreFrequently Asked Questions

Some people who are already receiving the Social Security benefits will get Medicare Part A (Hospital Insurance) and Part B (Medical Insurance) automatically, and some will have to sign up for it.

You can apply for Medicare thru the Social Security Website at https://www.ssa.gov

This is the easiest and fastest way to sign up and get financial help you qualify for.

You will need to create your secure Social Security account to sign up for Medicare or apply for Social Security benefits online.

Medicare Advantage and Medicare Supplemental Plans are offered through private insurance companies. Our friendly and experienced agents can help you to find a program that meets your needs and your budget. Remember, there is no cost to use our service. Simply call 888-808-7646 to speak with a local licensed agent.

Yes you can, but you’ll need to go to a local Social Security office to apply in person. If you’d like to apply for an Medicare Advantage or Medicare Supplemental Plan in person, simply contact us and request an appointment. Please note, you’ll need to apply for Original Medicare before you can enroll in an Medicare Advantage or Medicare Supplemental Plan.

Of course you can! Contact our office at 888-808-7646 and one of our friendly and experienced licensed agents will be happy to walk you through the enrollment process. We can do this in person, or over the phone.

You have a 7-month window to apply for Original Medicare: during the 3 months prior to your 65th birthday month, the month of your birthday, and the 3 months after your 65th birthday.

Yes, there are penalties for enrolling late. If you do not enroll in Part B coverage during your Initial Enrollment Period, you could be subject to penalties for as long as you have Medicare coverage.

After applying for your Medicare care, it typically takes about approximately 2-3 weeks for you to get your card. It may take longer if there are delays.

The Medicare General Enrollment Period is from January 1st to March 31 each year and allows individuals who missed their IEP (Initial Enrollment Period) to enroll on Medicare.

Besides qualifying for a Special Enrollment Period due to a life event, this is your only opportunity to apply for Original Medicare other than your Initial Enrollment Period.

When you sign up for Original Medicare during the General Enrollment Period, your coverage will begin on the first day of the month following your enrollment. For example, if you enrolled on March 5th, your coverage would start on April 1st.

Important Note: The General Enrollment Period is not a “safety net” for missing your IEP (Initial Enrollment Period). This enrollment period should only be used as a backup if you missed your Initial Enrollment Period. Late Penalties could apply if you enroll during the General Enrollment Period so make sure you budget for those additional fees if you enroll late.

Choosing a Medicare plan carries a high degree of importance for several reasons:

– You want the best healthcare coverage for your situation

– You want to keep you out of pocket expenses manageable

– You want a plan that you understand, so that you don’t experience unpleasant surprises.

– You want to take advantage of the best opportunities available to you during the appropriate time windows.

– You don’t want to experience shocking gaps in coverage.

Because Medicare can be a complicated topic, with many different plans available. It is easy to feel overwhelmed and confused. Working with an independent health insurance broker can help you make sense of all your options.

Insurance brokers are independent agents who represent multiple insurance carriers. This professional has dedicated their career to understanding the complex web of Medicare insurance options, and therefore has experience dealing with almost any situation imaginable.

Because brokers work independently, rather than for a specific insurance carrier, they can offer you knowledgeable guidance. You can feel confident that this professional is helping you identify you own priorities and needs and is using those to inform their recommendations.

After you’ve enrolled in you chosen plan, a broker continues to offer support. You will have access to a team that can answer your questions and help you learn about your policy. And in the event of a problem, you support team can help you:

– Solve billing errors

– File an appeal for coverage

– Access medications when pharmacy exceptions occur

– Answer questions about your coverage.

– Alert you when your coverage options change

Since broker are intimately familiar with each insurance provider’s underwriting procedures, they can offer you vital information regarding your application. Often you can save significant amount of time by applying for a policy through a broker, who already knows which companies are likely to accept you.

Brokers are paid a commission by the companies they represent, and that commission is prebuilt into the cost of each policy. The rate you pay for your Medicare plan is the same, whether or not you use a broker. When you enroll directly with the insurance carrier, they keep that commission money for themselves, rather than offering a discount.

That means you can access the personalized services of a broker at no extra cost to you. In addition, you can enjoy all of the continues extra benefits as part of the deal.

Health insurance brokers undergo hundreds of rigorous training hours on Medicare law before they begin working with clients.

Each broker must complete the following steps in order to represent Medicare insurance companies and provide vital assistance to their clients.

– Complete pre-licensure education according to state law

– Pass their state’s licensing exam

– Apply for and obtain, a license through the National Insurance Producer Registry.

– Complete AHIP Medicare Certification

– Purchase errors and omissions coverage, as required by law

– Apply for work through a brokerage firm, such as a National Marketing Organization or National Marketing Alliance

– Complete Annual Carrier Medicare Certifications

– Maintain Health Insurance License Continuing Education

Our licensed certified insurance agents are in the local area and are ready to answer your questions and help you with your Medicare application process – all at no cost to you.

Medicare has various rules and guidelines in place in order to protect beneficiaries.

When it comes to making changes to your Medicare Advantage plan and helping help with Medicare when you first turn 65, many beneficiaries are looking to work with a licensed insurance agent.

Sadly, many people have used a sales approach to profit from misunderstandings in the insurance world. Medicare Scope of Appointment rules are in place so that bad actors can be weeded out and to protect people like you from falling victim to scams.

The Medicare Scope of Appointment is a mandatory form that beneficiaries and potential beneficiaries must sign before meeting with an insurance agent to discuss Medicare Advantage options. The SOA form remains on file for ten years and protects all parties. It can also be collected verbally.

The Medicare Scope of Appointment 48-Hour Rule changes allows your agent an opportunity to better prepare for your meeting and gives you an opportunity to consult with your loved ones, caregivers, and conduct due diligence.

It’s important to note that while the CMS Scope of Appointment guidelines are in place, there are two notable exceptions:

- If you are in the final four days of an election period, you’re allowed to have a same-day SOA.

- Furthermore, if you walk into an insurance agency or brokerage and initiate the conversation about your coverage, there is still a need for an SOA but you don’t have to wait 48 hours. Walk-ins are exempt from having the 48-hour waiting period.

Telephonic Scope of Appointment

To ease any stress that the SOA process may bring, you can choose a telephonic meeting. As a consumer, you can speak with your agent via telephone and consent to an oral agreement. Your phone recording will then serve as a Scope of Appointment.

Under these conditions, the following criteria apply to your Medicare Scope of Appointment:

- Unless a beneficiary calls in, the waiting period is exempt.

- Each agent gets an SOA that is good for up to 12 months. Even if you drop a call, so long as the same agent reaches out, the SOA stands.

- However, a new Scope of Appointment is necessary if additional benefits are to be discussed within that timeframe.

How To Avoid Scams With Your Medicare Scope of Appointment

There is no reason for you to put up with high-pressure situations or scams when shopping for healthcare. Securing the coverage you need should be an educational process that helps you manage costs, risks, and provides peace of mind. Your Medicare Scope of Appointment is a tool that helps you accomplish all of this. Here’s how:

Work With a Licensed Agent That Proves Legitimacy

If you’re working with a licensed agent that is offering you a SOA, you’re in a good place. It’s the right thing to do and a requirement from the Centers for Medicare & Medicaid Services (CMS). However, you can double-check by running the agent’s license number online. Each state has its own resources but starting with your state’s Department of Financial Services is a great place to start.

Conduct Due Diligence on the Carrier

Your SOA provides you with time to conduct research on the carrier you either are reenrolling with or enrolling with for the first time. The same goes for brokers, you’ll want to be sure you’re working with a reputable company. Taking advantage of the Medicare 48-Hour Rule gives you plenty of time to make sure everything is on the up and up.

Assess Your Needs and Speak With Trusted Loved Ones

Part of your enrollment journey should include looking at your needs and discussing them with loved ones and caretakers when necessary. Seeking advice from trusted loved ones can help you look at both your budget and your healthcare needs from multiple perspectives. Knowing what you need is a great way to avoid high-pressure situations when signing up for coverage.

Here at ML Health Insurance Services, all our insurance agents are licensed and provide the Medicare Scope of Appointment when handling Medicare Advantage and Prescription Drug Plan enrollment. We are here to educate and respect the rules laid out by CMS to provide you with safe and viable options when shopping for your coverage.

TESTIMONIALS

Our Clients Say

Blog

ML Health Blog Entries

Medicare Insurance Updates, Healthy Living Tips, Ways to Stay Fit, Eating Well ideas and more...