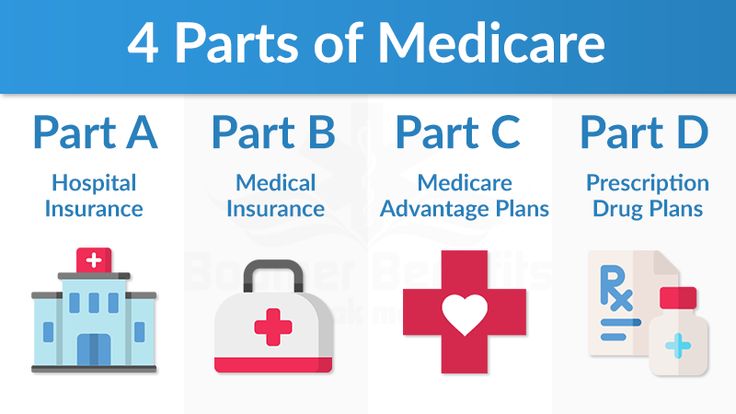

Different parts of Medicare pay for the different kinds of coverage. That is why it is crucial to understand Medicare basics.

Original Medicare includes Part A and Part B.

You can choose to enroll into either Original Medicare, which consists of Parts A and B, and add a Medicare Supplemental Plan and a Stand Alone Part D plan or you can enroll into a Part C Plan (also called Medicare Advantage). In most cases, you’ll need to use doctors who are in the plan’s network with a Medicare Advantage plan.

For more information about the basics of Medicare click here. It covers all you need to know about Medicare basics.

MEDICARE PART A

Medicare Part A covers costs related to:

MEDICARE PART B

Medicare Part B provides for the rest of your non-hospitalization healthcare needs. Understanding Part B is fundamental to grasping Medicare basics. Under Part B you receive coverage for:

MEDICARE PART C

Medicare Part C, or Medicare Advantage are offered by private health insurance companies that contracts with Medicare. They are designed to roll the coverage of Part A and B into one plan. By law, Medicare Advantage plans must offer at least the same coverage as Original Medicare. Other rules may differ, or the network might offer additional benefits. Many Medicare Advantage plans also include Part D prescription drug coverage. Knowing these basics about Medicare Part C is essential.

MEDICARE PART D

Medicare Part D are known as the Prescription Drug Plan. It covers costs related to medications and is an important aspect of Medicare basics.

As you can see, Medicare is available in different “parts”, all of which are designed to fit together to offer comprehensive coverage.

MEDICARE SUPPLEMENT (MEDIGAP)

When you choose to stay with Original Medicare, you will need to find a Medi-gap or Medicare Supplemental plan with a stand-alone Prescription Drug plan to help fill the gap that Original Medicare doesn’t cover.

Medicare Supplemental (Medigap) plans are offered thru private insurance companies. These policies are standardized and in most states named by letters like Plan G or Plan K. The benefits in each lettered plan are the same, no matter which insurance company sells it.

To purchase Medicare Supplement Insurance (Medigap), you must be enrolled in Part A and Part B. Medicare Supplement Insurance provides coverage for gaps in medical costs not covered by Medicare. Medicare Supplement plans are standardized and offer various benefits to help offset your healthcare cost.

Here is a great resources: Medicare & You 2026, available from Medicare.gov

Do you still have questions? Schedule a no-cost appointment and we will help you! Choosing insurance can be hard. We make it easy!